The Superbill: Your Key to Out-of-Network Reimbursement

October 28, 2025

Choosing an out-of-network provider can offer access to specialized care, more flexibility, and a stronger therapeutic relationship, but it often comes with a higher upfront cost. If you've ever paid out-of-pocket for a visit and wondered if you could get some of that money back, you're in the right place. The answer lies in a powerful document called a superbill.

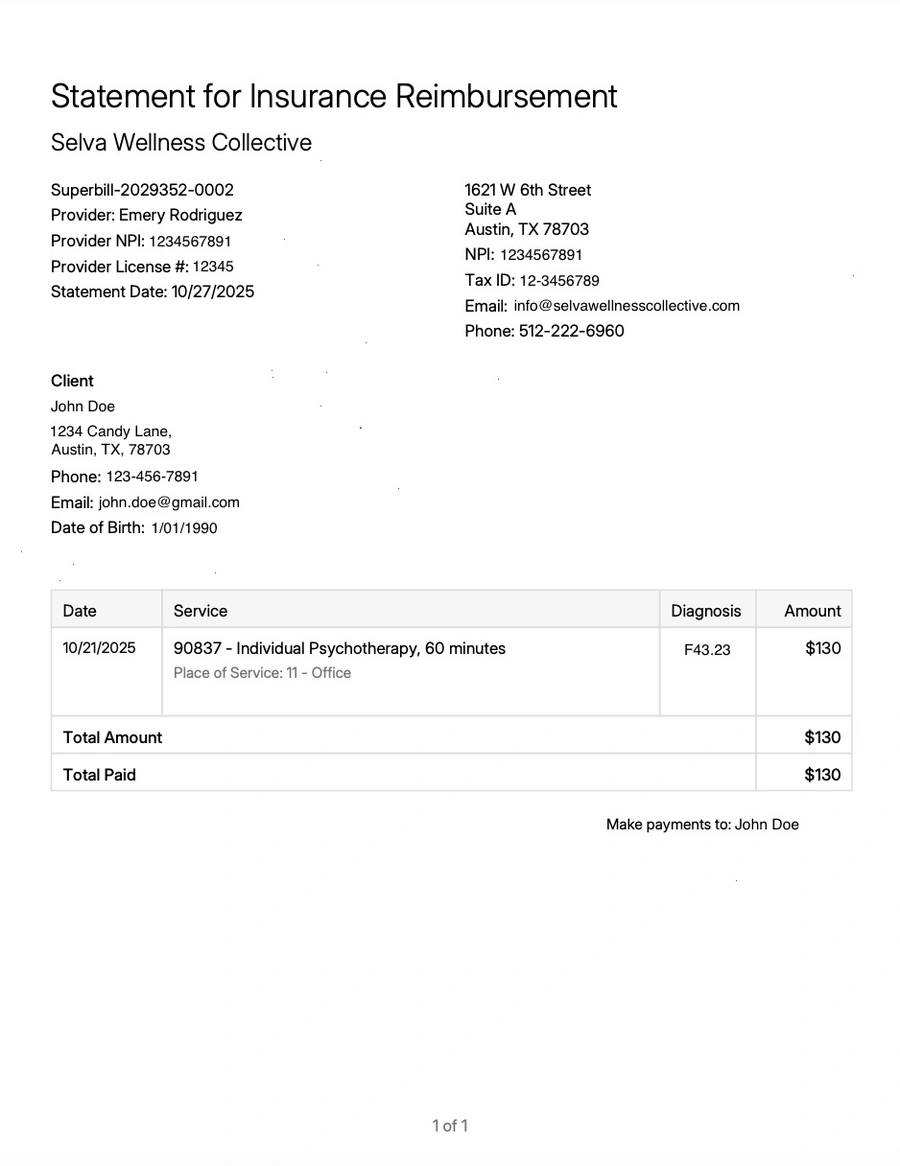

Unlike a standard receipt, a superbill is a detailed invoice created by your provider specifically for insurance companies. It contains all the necessary information for you to submit a claim and get reimbursed for a portion of the services you've already paid for. Understanding what a superbill is and how to use it can unlock your out-of-network benefits and make your healthcare more affordable.

What's on a Superbill?

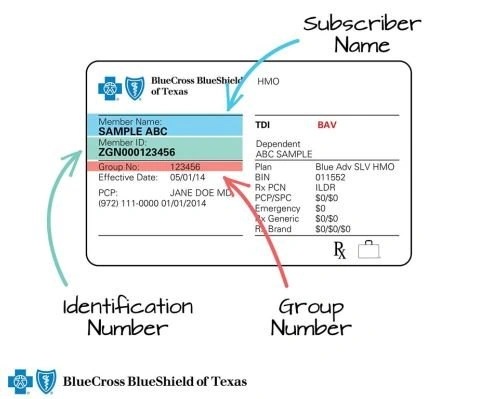

Think of a superbill as a comprehensive summary of your appointment. It's a single document that includes all the information an insurance company needs to process a claim, including:

Patient information: Your full name, date of birth, and contact details.

Provider information: The provider's name, address, National Provider Identifier (NPI) number, and other professional credentials.

Dates of service: The specific dates you received care.

Diagnosis codes (ICD-10): The medical codes that describe your diagnosis. This is crucial as it justifies the medical necessity of the services.

Procedure codes (CPT codes): The codes that describe the specific services you received (e.g., a 60-minute therapy session or a physical therapy evaluation).

Fee and payment details: The amount charged for each service and the total amount you've paid.

How to Use a Superbill to Get Reimbursed

Submitting a superbill is your responsibility as the client. While the process can seem a bit daunting at first, it's often straightforward. Here's a step-by-step guide:

1. Know Your Benefits

Before you even start, call your insurance provider and ask about your out-of-network benefits. This is a critical first step. Ask these key questions:

Do I have out-of-network benefits for the specific services I'm receiving?

What is my out-of-network deductible? Have I met it?

What is the coinsurance rate, or what percentage will my plan reimburse for out-of-network services?

Is pre-authorization required?

2. Get the Superbill from Your Provider

After your appointment, request a superbill from your provider. Most providers who don't accept insurance are familiar with this process and can generate one for you. They may provide it monthly or after each session.

3. Submit the Claim

Your insurance company will have a specific process for submitting out-of-network claims. Common methods include:

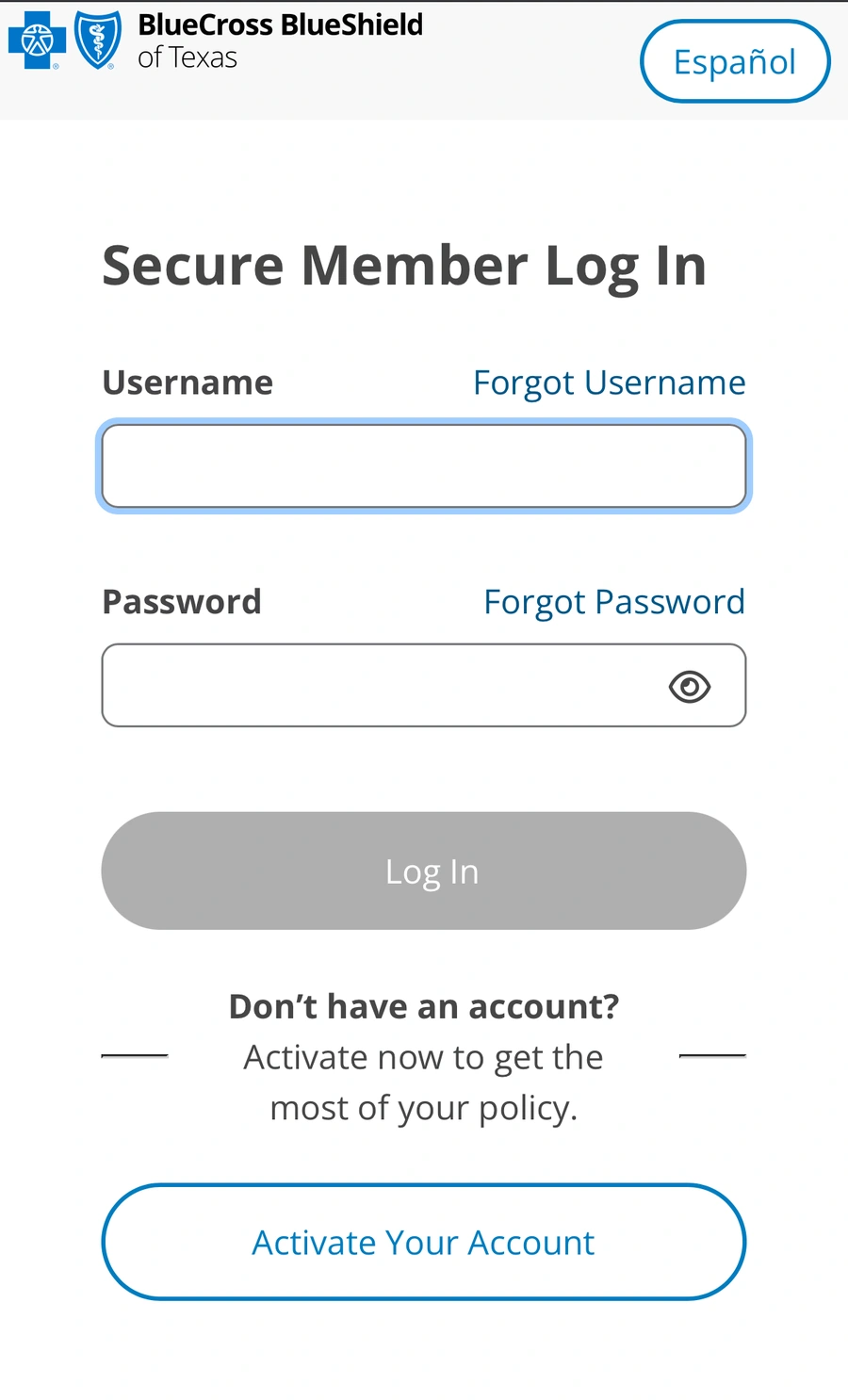

Online portal: The fastest and most secure method is often through your insurance company's member portal.

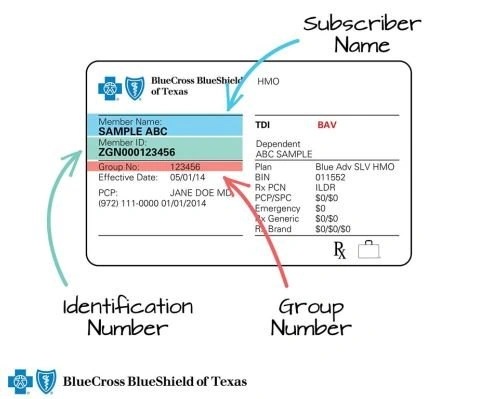

Mail: You may need to print a claim form from their website, fill it out, and mail it with the superbill to the address provided on your insurance card or website.

Fax: Some insurance companies still accept faxed submissions.

Be sure to fill out any required claim forms completely and accurately, ensuring the information matches the superbill exactly.

4. Follow Up

Once you've submitted the claim, keep a copy of everything for your records. You can typically track the status of your claim through your insurance company's online portal or by calling their customer service line. Reimbursement times can vary, but it's important to be persistent.

Remember, a superbill doesn't guarantee full reimbursement, but it is the essential first step to recovering a portion of your healthcare costs. By understanding this process, you can make informed decisions about your care and confidently access the providers you need.